About the FAST Act

Source: ARTBA 2015 "Fixing America's Surface Transportation Act", A Comprehensive Analysis (PDF)

On December 4, 2015, President Obama signed into law H.R. 22, the Fixing America’s Surface Transportation (FAST) Act (Pub. L. No. 114-94). This is the first surface transportation law in over 10 years that provides long-term funding for infrastructure planning and investment.

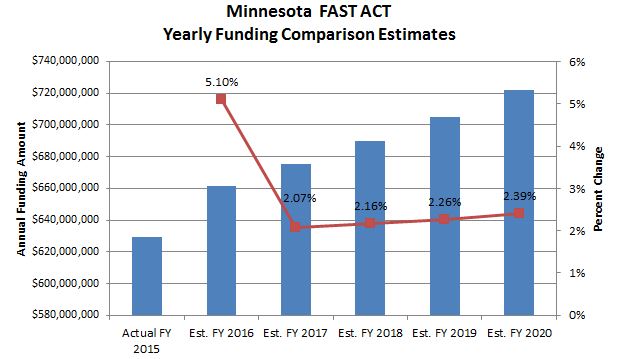

Funded by the Motor Fuels Tax and by non-transportation related offset, the FAST Act authorizes over $305 billion for federal fiscal years 2016-2020. States will receive a 5.1 percent increase in formula funds in 2016 followed by modest annual increases ranging from 2.1 percent in 2017 to 2.4 percent in 2020.

1. Motor Fuels Tax

The federal motor fuels tax raises approximately $34 billion per year and funds the Highway Trust Fund. The tax is made up of:

- Gasoline - 18.4 cents per gallon

- Diesel fuel - 24.4 cents per gallon

The motor fuels tax has not been increased since 1993 and has not been indexed for inflation. The FAST Act does not increase motor fuel taxes (user fees) but relies on offsets of $70 billion to help fund the bill. See Motor Fuel Data and the Highway Trust Fund for more information.

2. Offsets

Additional money for the FAST Act is generated through offsets from other areas of the federal budget - from items not related to transportation. These include:

- $6.9 billion from Federal Reserve Bank dividends

- $53.3 billion from the Federal Reserve Bank Surplus Account

- $6.2 billion from the sale of 66 million barrels of oil from the Strategic Petroleum Reserve

- $2.4 billion from privatized tax collections

- $.395 billion from changes in passport rules

The FAST Act does not address long term funding of federal highway and public transportation programs. There is no increase in the federal motor fuels tax and offset funding is finite. To address this issue, the FAST Act established the Surface Transportation System Funding Alternatives (STSFA) Program. The purpose of the program is to provide grants to States to develop and demonstrate a user based alternative mechanism to help fund the HTF. Minnesota is actively pursuing this opportunity.

Minnesota public review

On February 29, 2016, MnDOT and the Transportation Alliance hosted a FAST Act workshop to provide information on the new federal law and to discuss what it means for the future of Minnesota’s transportation system. Workshop participants included MnDOT, Metropolitan Planning Organizations, cities, counties, consultant groups, construction and engineering companies, and regional rail authorities.